For many growth-stage companies, listing on the Nasdaq Capital Market is a key milestone that can elevate brand visibility, enhance credibility, and provide access to a broader pool of investors. As one of the most sought-after U.S. exchanges for smaller and mid-sized companies, the Nasdaq Capital Market offers an ideal platform for businesses aiming to go public. However, achieving a successful IPO on Nasdaq requires thorough preparation and compliance with specific requirements. Here’s your ultimate checklist to determine if your business is ready for a Nasdaq Capital Market listing.

1. Meet Nasdaq Capital Market Requirements

Before diving into the IPO process, ensure your company meets the listing requirements of the Nasdaq Capital Market.

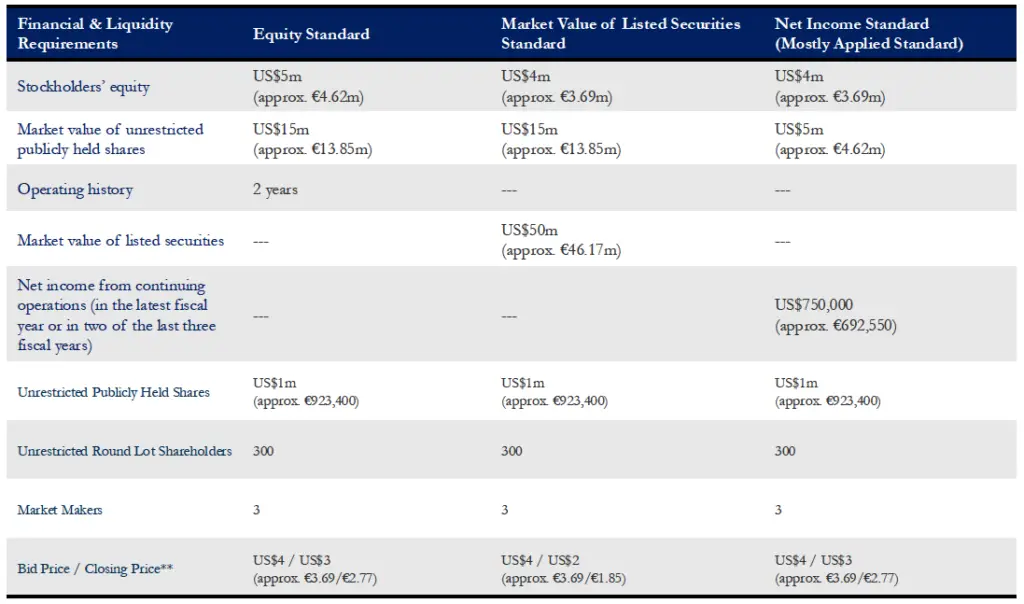

Companies can qualify using one of three standards: the Equity Standard, the Market Value Standard, or the Net Income Standard.

Source: https://listingcenter.nasdaq.com/assets/initialguide.pdf

Most companies opt for the Net Income Standard, which requires:

- Net Income (i.e., Net Profits):

- At least USD 750,000 in net income for the most recent fiscal year or in two of the last three fiscal years.

- Public Float:

- At least 1 million publicly held shares.

- Minimum Bid Price:

- A minimum bid price of USD 4 per share.

- Shareholders:

- At least 300 shareholders, each holding at least 100 shares.

Review your financials against these metrics to confirm eligibility before proceeding.

2. Assess Financial Health and Stability

A strong financial foundation is essential for a successful Nasdaq IPO. Key financial indicators include:

- Consistent Revenue Growth: Nasdaq investors look for steady, reliable growth. Ensure your company has demonstrated strong financial performance over the past few years.

- Audited Financials: Nasdaq requires audited financial statements prepared in accordance with U.S. GAAP. Partner with a reputable audit firm, which we can help source as part of our advisory services, to ensure compliance and address any discrepancies early in the process.

- Cash Flow and Liquidity: Robust cash flow and sufficient liquidity signal that your business can sustain operations and growth post-IPO. It’s essential to review your working capital and liquidity ratios to confirm the company can meet its financial obligations.

3. Strengthen Corporate Governance

Compliance with Nasdaq’s governance standards is critical for a successful listing. Enhance your corporate governance structure by:

- Establish a Board of Directors and Key Management: For a Nasdaq Capital Market IPO, the company must disclose its intended governance structure in the prospectus. This includes providing information on:

- Executive Directors and Key Management: The prospectus should list the names, titles, and qualifications of the company’s key executives, such as the CEO, CFO, and any other executive directors. Their industry experience, leadership skills, and responsibilities within the company should be highlighted, as these roles are crucial for strategic decision-making and daily operations.

- Independent Directors (INEDs): While the appointment of independent non-executive directors (INEDs) is not required before the IPO, the company must outline its plan to appoint INEDs post-listing in its prospectus. The prospectus should include the names and qualifications of any proposed independent directors, emphasizing their expertise in finance, legal, and governance matters.

- Board Composition: The overall composition of the board, including the mix of executive, non-executive, and independent directors, should be clearly described. This demonstrates a balanced approach to governance and effective oversight.

- Implement Compliance and Risk Management Policies: Although a full internal control audit isn’t required at the time of listing on the Nasdaq Capital Market, it’s advantageous to establish strong internal controls and risk management policies early. These measures, which must also be disclosed in the prospectus, help streamline future compliance, reduce regulatory risks, and build investor confidence.

- Prepare for Post-IPO Governance Requirements: Although certain governance requirements are not mandatory pre-IPO, companies should plan for future compliance.

- U.S. domestic companies must file quarterly reports (Form 10-Q), annual reports (Form 10-K), and promptly disclose material events via Form 8-K.

- In contrast, foreign private issuers (FPIs) only file an annual report (Form 20-F) and may use Form 6-K for interim updates as needed.

- While internal control audits under Section 404(b) are not required at listing, both U.S. companies and FPIs should establish strong internal controls early to ensure smoother compliance as the company grows and regulatory requirements increase.

4. Assemble Your Nasdaq IPO Team

Navigating a Nasdaq Capital Market IPO requires a carefully selected team of experts, and having an experienced IPO adviser is crucial to ensure alignment and minimize conflicts. Here’s how we can support you:

- IPO Adviser (Like Us): As your lead adviser, we take full responsibility for overseeing and coordinating the entire IPO process. We leverage our extensive network to source top-tier professional teams—legal counsel, auditors, and underwriters—who are aligned with your business goals. This alignment is critical, as disagreements among parties are a common reason for IPO delays and failures. Our oversight ensures that all stakeholders work cohesively towards your successful public listing.

- Early-Stage Due Diligence: To optimize costs, we first bring in legal counsel and auditors to conduct preliminary legal and financial due diligence on your business. This step allows us to identify and address any potential issues early, ensuring your company is well-prepared before engaging the full IPO team. By resolving key concerns upfront, we streamline the process and avoid costly surprises later.

- Legal Counsel: We source experienced U.S. securities law firms to handle Nasdaq-specific regulatory filings and compliance. Their expertise is critical for navigating the complex legal requirements of a Nasdaq IPO.

- Auditors: We connect you with reputable audit firms familiar with U.S. GAAP standards and Nasdaq’s financial requirements. Their thorough due diligence and financial review help build credibility with investors and regulators.

- Underwriters: We partner with experienced underwriters, including leading financial firms and specialized boutique underwriters, with a strong track record in Nasdaq listings. They assist in pricing, marketing, and distributing your shares, helping you achieve a successful capital raise and market entry.

By taking a strategic approach to assembling your IPO team, we ensure that every professional party is aligned with your objectives, minimizing risks and maximizing the chances of a seamless IPO process. Our hands-on coordination and strong relationships with trusted partners are key to driving your IPO project to a successful public debut.

5. Conduct Comprehensive Due Diligence

Due diligence is vital for a successful Nasdaq IPO, ensuring your company’s financial, legal, and operational readiness. Key areas of focus include:

- Financial Review: Accurate, U.S. GAAP-compliant financials are essential. We partner with top auditors to verify and resolve discrepancies early.

- Legal Compliance: Address any legal risks through a thorough review of contracts, intellectual property, and potential liabilities.

- Operational Assessment: Identify and fix any internal inefficiencies, ensuring smooth operations as you prepare

6. Craft a Strong Investment Story

A strong investment narrative is essential for attracting Nasdaq investors, and this is where an experienced IPO adviser can provide invaluable support. We help you develop a clear and persuasive story that highlights:

- Growth Potential: Showcase the size of your market opportunity and outline realistic expansion plans, emphasizing future scalability.

- Unique Value Proposition: Clearly communicate what sets your business apart from competitors, demonstrating your unique strengths and market differentiation.

- Proven Leadership: Highlight the expertise and track record of your management team, showcasing their capability to execute the company’s vision and deliver strategic goals.

We guide you through this process, refining your investment story to resonate with investors and build confidence in your public market debut.

7. Prepare Nasdaq IPO Documentation

The documentation process for a Nasdaq IPO is comprehensive and varies slightly between U.S. domestic companies and foreign private issuers (FPIs). Key documents include:

- Form S-1 Registration Statement (U.S. Companies): This is the primary filing with the SEC, providing a detailed overview of your company’s business model, financial performance, risk factors, and future plans. It includes all necessary disclosures and serves as the foundation for investor information.

- Form F-1 Registration Statement (Foreign Private Issuers): FPIs file the Form F-1, which is similar to the S-1 but tailored for foreign companies. It includes audited financials (prepared under U.S. GAAP or IFRS), business descriptions, risk factors, and details on corporate governance.

- Prospectus: A core component of both the S-1 and F-1 filings, the prospectus is presented to potential investors. It outlines the company’s financials, business strategy, use of IPO proceeds, and potential risks, helping investors make informed decisions.

- Corporate Restructuring Documents: Companies may need to undergo restructuring to meet Nasdaq’s listing requirements. This can include redomiciling, forming a holding company, or adjusting the equity structure. Once we are engaged and have completed due diligence with our legal counsel, we guide you through this process, preparing all necessary legal documents to ensure compliance and streamline the IPO journey.

An experienced IPO adviser can guide you through the entire documentation process, helping to ensure accuracy, compliance, and clear communication of your company’s value proposition to investors.

8. Create a Detailed IPO Timeline

A well-planned IPO timeline is crucial for a successful Nasdaq listing. While the overall preparation can vary based on your company’s financial performance, as your IPO adviser, we tailor a customized timetable that maximizes your chances of success. The Preparation Phase may be extended if needed, allowing your company to strengthen its financials before proceeding. Our strategic approach involves overlapping phases to optimize efficiency:

- Preparation (3-6 months or longer): We guide you through financial audits, corporate restructuring, and assembling your IPO team. This phase can be adjusted based on your financial performance, giving you the flexibility to prepare thoroughly. Early drafting of Form S-1 or F-1 helps expedite the filing process.

- Filing (2-3 months): We manage the submission of regulatory documents while simultaneously planning investor roadshows and marketing activities, ensuring tasks overlap to maintain momentum during the SEC review process.

- Marketing (1-2 months): We conduct investor roadshows and gather feedback, overlapping with final pricing discussions and regulatory approvals in the Listing Phase.

- Listing (1 month): We finalize the offering price, complete the last steps with Nasdaq, and officially launch your IPO.

9. Plan for Post-IPO Life

Going public is not the end—it’s the beginning of a new phase for your company. Be ready to meet the demands of a public company, including:

- Ongoing Compliance: Maintain transparency with investors and comply with reporting requirements.

- Investor Relations: Establish a strong investor relations strategy to communicate effectively with shareholders.

- Business Growth: Use the raised capital strategically to drive expansion and increase shareholder value.

Final Thoughts: Is Your Business Ready for Nasdaq?

Going public on the Nasdaq Capital Market opens new growth opportunities but requires careful preparation and expert guidance. At Lumina Consulting, we provide end-to-end support for Nasdaq IPOs. Schedule a free 30-minute Readiness Assessment with us to evaluate your company’s stage and outline the steps to a successful IPO.